Getting Approved For Abdominal Aortic Aneurysm Life Insurance

Can you get abdominal aortic aneurysm life insurance?

Is aortic aneurysm fatal?

The pain of aortic aneurysm bursts is often sudden and severe, with eight out of 10 people dying before they reach the hospital.

If you suspect your loved one has experienced these symptoms, you must take them immediately for surgery!

This is why life insurance companies take this health impairment very seriously. You should talk to an independent life insurance agent to determine life insurance rates.

The life insurance company will want a snapshot of the overall medical history. This will determine the risk factors then you can be matched up with the correct life insurance company.

Above all, you can still get affordable life insurance coverage with abdominal aortic aneurysms in your history.

We will also discuss the top insurance carriers for aortic aneurysms, so read on.

Article Navigation

- How can I get life insurance if I have an aortic aneurysm?

- Can I get life insurance after my aortic aneurysm surgery?

- Burial Insurance Underwriting For Abdominal Aortic Aneurysm

- Can I get life insurance if I had an aneurysm before?

- Abdominal Aortic Aneurysm Life Insurance

- Tell me the insurance company’s response to an aortic aneurysm.

How can I get life insurance if I have an aortic aneurysm?

To get a life insurance policy with an abdominal aortic aneurysm, you will need to speak to a licensed life insurance agent so he/she can determine which life insurance companies are best.

First, we will determine how much coverage you have and which life insurance products are best for you. Second, you must understand the underwriting factors to determine rate class.

You do this by answering medical questions and medical history. In addition, you will have to acknowledge applicable HIPAA privacy laws.

Once we go over the pre existing conditions and health issues, we can isolate the proper rate class. This will determine the final rates.

Then your independent agent will compare rates from multiple companies and make sure the life insurance carrier picked will have liberal underwriting guidelines for the pre existing condition of aortic aneurysms.

The health class, product, and underwriting requirements will determine the right life insurance company. Most life insurance companies want health or personal information to finish the application process.

To conclude, you have finished the life insurance application process and should get instant approval or a decision within 24 hours, depending on the life insurance company.

Can I get life insurance after my aortic aneurysm surgery?

Abdominal aortic aneurysm (Corrected)

Yes, you can still get affordable coverage on a life insurance plan. However, most life insurance companies will want to see 2 years from treatment until you can take day one coverage. This is because you are still at increased risk for an aneurysm rupture.

So the carrier knows that this condition is life-threatening and could cause internal bleeding. However, Mutual of Omaha will take you to level immediate coverage.

Abdominal aortic aneurysm (Not corrected)

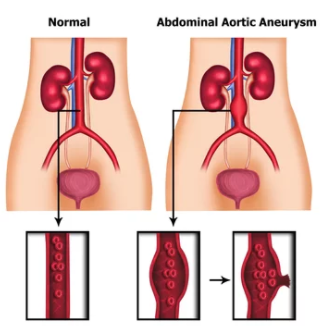

Now, if you have an aortic aneurysm that wasn’t corrected yet it will come down to the size of the blood vessel to determine care.

Many complications could happen, such as chest pain, not having the proper blood flow, other blood vessels being affected, and a cerebral aneurysm or brain aneurysm.

In addition, it could cause issues in the left ventricle or the aortic valve. So when buying life insurance with a thoracic aortic aneurysm history most carriers will give you modified life insurance policies.

These policies hold waiting periods or percentage payouts for 1-3 years.

We would still bring you to Mutual of Omaha; however, if there are other health conditions like heart disease, pacemaker, or other severe medical conditions, then we would look at Royal Arcanum graded or AETNA CVS after one year.

Read What Our Clients Say About Us

Burial Insurance Underwriting For Abdominal Aortic Aneurysm

How serious is an aneurysm in the aorta?

It’s pretty serious, as an episode of high blood pressure can cause an aneurysm rupture. That’s why only 8/10 do not survive before they get to the hospital.

So when purchasing life insurance from any licensed insurance agent, you will need to go through the underwriting process with questions that determines the premiums you pay.

They will prequalify you by asking medical questions to determine the proper rate class or health class.

They won’t ask you to do a medical exam. They will do a MIB hit to check medical records and codes. They will also look at other health conditions.

Furthermore, knowing that a life insurance policy vary between carriers and underwriting guidelines, should give you an accurate rate when you compare quotes.

The life insurer will not be concerned about family history, so if you have cancer or heart disease in your family, it won’t penalize you like if it was a term life insurance policy.

Can I get life insurance if I had an aneurysm before?

Can an aortic aneurysm go away?

The success rate for circulatory surgery to treat abdominal aortic aneurysms is more than 90%. If you are diagnosed with this condition and have concerns about your health, it may be worth consulting with a physician who specializes in cardiovascular care.

It is no secret that we all have a tendency to worry about our health. We are constantly looking for any sign of disease or illness, afraid the worse could happen at any time without warning us in advance!

When it comes down to Abdominal Aortic Aneurysms (AAA) and Coronary Artery Disease (CAD), most folks don’t realize how closely linked they actually can be.

So yes, you can get aneurysm coverage for affordable life insurance rates. The life insurance company that will offer you a policy will be a life insurer that specializes in AAA.

So you do not have to worry about settling for an inferior carrier like Ethos.

Abdominal Aortic Aneurysm Life Insurance

How long can you live with an aorta aneurysm?

The median lifespan of people with aortic aneurysms is 18 months.

Twenty-five percent will suffer from rupture at some point in their life; only one out of 10 survive more than two decades after being diagnosed!

Life insurance companies are very well educated about these risks but will still give life insurance coverage.

However, if you have other underlining medical issues like uncontrolled blood pressure or coronary artery disease then it may affect your rate.

When purchasing life insurance, you want to ensure you have the best life insurance rates. So you need to be matched up with a suitable life insurance carrier for the best life insurance coverage.

Tell me the insurance company’s response to an aortic aneurysm.

When you first do a consumer inquiry, display quotes for your life insurance needs. In most cases, it is very simple.

However, life insurance companies tend to surprise you by that phone interview, or in some cases, they could ask for prior written authorization to get your medical records.

Although rare, it does happen sometimes.

This is why it is essential to be with the right life insurance company. Sometimes if negotiations with the insurance company isnt going anywhere, then requesting the medical director look at the file usually is the last straw.

Above all, the most important part of the process is making sure you are using an experienced life insurance agent.

So if you were purchasing life insurance with an aortic aneurysm, the best three carriers for the final expense is:

- Mutual of Omaha (Living Promise)

- CVS (Aetna Accendo)

- Royal Arcanum (Graded Benefit)

For Term Life Insurance:

- Protective Life

Conclusion

So what are you waiting for? Get a quote today to see how much your life insurance would be with an abdominal aortic aneurysm.

And don’t forget, we can help you find the best rates regardless of your health history. So we will find you the best coverage, whether it is $10,000, $25,000, or $40,000.

Most Recent Articles

- 2025 Mutual of Omaha Burial Insurance (Rates, Features, and Costs)

- Beware of Burial Insurance Scams: Protecting Seniors from Fraudulent Practices

- Transamerica FE Express Solutions Review: Fast, Affordable Final Expense Coverage

- Is Burial Insurance Worth It? A Complete Guide to Understanding Its Value

- Family Benefit Life Insurance Company Review: Is It Right for You?