The Truth About Pre-Need vs. Final Expense Funeral Plans In 2024

Let’s talk about the truth about funeral pre-need vs final expense insurance and what it will mean to your family when you pass away.

The death of loved ones is never an easy thing to face. It’s hard enough when they die unexpectedly, but it can be even more difficult when you have the added worry about how their funeral pre need arrangement will be handled.

This blog post will offer some insight into funeral pre-need plans vs final expenses and help you decide which option might work best for your family. Let’s get started with pre-need life insurance!

Article Navigation

- What Is Pre-Need Burial Plans

- Pre-Need Funeral Planning Checklist

- Are Pre-Need Burial Plans Worth It

- Pros and Cons of Prepaid Funeral Plans

- Is Final Expense Insurance Worth It

- Prepaid Funeral Plans Pros and Cons

- Pre-Need or Final Expense Insurance For My Parents

- What Is The Average Cost Of Funeral Insurance

- About the Author

- Conclusion

What Is Pre-Need Burial Plans

It can all be so overwhelming… What is the difference between pre-need funeral insurance vs the best funeral insurance with an A+ rated insurance funeral provider…

What is pre need insurance? A pre-need funeral plans is used to pay for the costs of a traditional funeral or a cremation.

How does a prepaid funeral plan work? You and the funeral home create a pre need contract and make the funeral arrangements for your funeral costs. You make an upfront payment to your funeral homes.

In fact, you work directly with the funeral home. You could make a lump sum payment or make monthly payments that could range anywhere from $50 – $150 dollars or more depending on the plan you choose.

An average final expense insurance premium is considerably less. (we will discuss this later in this article)

Pre-Need Funeral Planning Checklist

What is a pre need insurance arranger?

Some of these funeral expenses include the cemetery plot, your casket, music, flowers, embalming, gravesite, transportation fee and fee changed by the cemetery. It includes hearse or van use, opening the ground, and all burial services.

Most importantly, why you should avoid the pre-need plan trap. There are more cons than you realize and as a senior specialist, I want to spare you and your family the heartache that I have seen too many times.

Are Pre-Need Burial Plans Worth It

Are pre-need burial policies a good idea? In short, NO! Here is a list of why…

Funeral directors could claim bankruptcy. How will you know that upon your death, the costs have not increased? The money you have pre-paid may not cover all the funeral expenses.

Your family may still have to come out of pocket as there are no guarantees at all.

Most importantly, the funeral home you choose is now your beneficiary. Usually, it is your loved one, spouse, adult children, etc.

Is is safe to Prepay a funeral?

What happens if the funeral home changes owners? What happens if you move out of state? These are just a few of the questions you must ask yourself before signing a pre need contracts with any funeral home.

Pros and Cons of Prepaid Funeral Plans

Preneed insurance plans are becoming more popular as the population ages. Here’s some information on the pros and cons of these types of plans, including two examples of pre-need funeral providers near you.

If the idea of advance funeral planning out your own future funeral arrangements sounds like a good way to ease your family members’ minds after you’re gone, a prepaid funeral plan may be right for you.

Pre-need funeral plans allow you to lock in current prices of funeral goods and services, ensuring that your loved ones won’t have to pay more than the plan’s agreed-upon price tag when the time comes.

Most importantly, preneed funeral insurance provides peace of mind. Knowing that your loved ones won’t have to worry about funeral costs. And that your final wishes will be carried out just the way you wanted them – can be a great comfort.

There are a few downsides to pre-need funeral plans, however. First, they’re not always affordable, so make sure you do your research and compare prices before signing up.

In addition, if you decide to change your plans after signing up for a preneed funeral plan, it may be difficult or impossible to make those changes.

These types of plans are also considered very final. It meaning that if a family member passes away without having signed up for a pre-need funeral plan, the costs will likely be much higher than they would be if the deceased had signed up for pre-need funeral coverage prior to death.

Is Final Expense Insurance Worth It

Absolutely! When you apply for final expense insurance as opposed to a pre-need burial plan, you are creating protection from the funeral costs on your loved ones at the most emotional and difficult time of their lives.

Preneed insurance vs. final expense insurance policy?

Unlike pre-paid policies, your beneficiary receives the death benefit upon your death. The death benefit will cover all the funeral expenses we have listed above.

There are no limitations, and if there is money left over, that is to do what they wish.

Prepaid Funeral Plans Pros and Cons

One pro of a prepaid funeral plan is your family will not have to make those decisions.

A major con to prepaid funeral plans is you cannot change your mind if you want to be buried elsewhere. You and your funds will be committed and this limits you tremendously.

When you pass away your family will not receive a death benefit for your final expenses or funeral costs.

Pre-Need or Final Expense Insurance For My Parents

I get calls daily from clients asking me what is the best option for them to protect their family from the financial burden when their parents pass away.

Although many people think of pre-paid is the right answer, it truly is not.

In fact, prices today are not prices tomorrow. So if you start making payments on a preneed insurance plan and your mom or dad passes away, will you be able to come out of pocket for the rest of the funeral costs?

Sadly, in my experience, most of my clients answer no.

Why should adult children get final expense insurance policies for their parents?

A final expense policy ensures that when your mom or dad passes away, the insurance company cuts you a check for the death benefit within a 24-48 hour period for the face amount.

What Is The Average Cost Of Funeral Insurance

What affects final expense insurance monthly premium cost?

This is a great question. Final expense policy AKA Funeral Insurance is based on your personal profile, age, medical health impairments. current prescriptions you are taking.

Also, keep in mind, these final expense insurance policies are Day One Level Benefits. This is key.

This is what we strive for. We will also ask you a comprehensive series of health and lifestyle questions to determine which type of policy you qualify for.

To give you an idea of cost per month (see below)

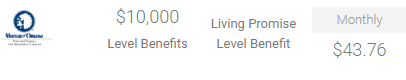

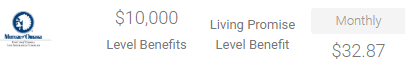

Nonsmoker, 60-year-old male in decent health, the monthly premium for 10k in coverage is:

Nonsmoker, 60-year-old female in decent health, the monthly premium for 10k in coverage is:

As you can see above, now is the time to get final expense policy for your parents. As you age and you do not lock into a policy, rates increase.

Also, keep in mind as you age, medical conditions change and you may not qualify for day one level coverage. Ask us today how to avoid paying more!

About the Author

My name is Lisamarie Monaco. I am a Senior Specialist with InsuranceForBurial.com.

In fact, I am also your personal advisor. I am here to help you achieve your goals of protecting your loved ones from the financial burdens when you pass away.

I shop you to dozens of A+rated Excellent insurance carriers in one simple phone call. They call me the one-stop shopping machine!

My goal and passion are to give you all the information you need to make the best choices for you and your family.

I am mindful of your budget and also mindful to give you the best product for you at this stage of life.

I will hold your hand throughout the entire process. Call me today to go over all your options, (855) 380-3300 ext. 5

Related Articles

Conclusion

The decision between a funeral preneed plan and final expense insurance is not an easy one.

Final expenses are often unpredictable, but the good news is that we can help you find out which option best suits your needs before it’s too late.

We know how important these decisions are to you, so let us do what we do best – help! Call today for more information or click here to get started on our simple online quote request form.

Thank you for considering Allstate Life Insurance Company as your partner in planning ahead and also providing peace of mind about finances should anything happen to you tomorrow.