2024 Life Insurance Savings Group Reviews Seniors Must Read

Life Insurance Savings Group is known for selling final expense and term life insurance. But has their track record of providing good coverage been consistent?

Should you be worried about them paying a death benefit? Have you looked at Life Insurance Savings Group complaints?

Don’t worry, we checked them out, and many people are left wondering whether or not this company’s plans will actually save them money in the long run!

We put them up against the best life insurance companies in the industry, and they fall short. After the most recent earnings from their Mother Company Selectquote, you might wonder if they can pay future claims.

Is Life Insurance Savings Group the best life insurance company… WE SAY NO!!! There are more superior companies that offer better life insurance products for vision expenses that pay a death benefit.

Speak to one of our insurance professionals, but first, let’s go over this company with a fine-tooth comb.

Table of Contents

Life Insurance Savings Group, Who Are They

Above all, Life Insurance Savings Group or lifeinsurancesavings.com specializes in marketing final expense life insurance for applicants.

In addition, Life Saving Group is also a marketing up for one of the largest telesales agencies in the industry. You may have heard of them, SelectQuote.

In fact, yours truly used to be one of their top-producing licensed agents before I opened up PinnacleQuote, the mother company of InsuranceForBurial.com. Now I am one of their competitors.

Overall, the biggest reason why I left and opened up my own independent agency was that the client was never put first in these agencies.

In addition, they were limited in the final expense insurance companies they offered.

Getting the right life insurance policy for you should be the number one priority.

Life Insurance Savings Group offers you the most reliable and convenient way to pay for medical and final expenses and save money on health insurance by combining the best features of widely accepted health plans like Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), and Health Reimbursement Arrangements (HRAs).

Final Expense Insurance

Policyholders with final expense insurance can help their loved ones pay for funeral and burial costs when the insured passes away by providing a modest amount of coverage.

Usually, there are no restrictions on the use of the death benefit. It may also be used to pay off other expenses debt, such as medical bills and credit card debt.

Most life insurance savings groups advertise policies that come with up to a saving contribution of $25,000 in death benefits.

And they guarantee approval to people 45 to 85 without having to undergo a medical examination.

Most coverage begins immediately. However, specific guaranteed plans may limit the number of payouts during the first two years after an accident.

Term Life Insurance

The typical term life plan from Life Insurance Savings Group lasts 10 to 30 years but can be shortened or extended at your request.

Some life insurance policies guarantee the same premiums. And policyholders can choose to pay their premiums monthly, quarterly, semi-annually, or annually.

No medical examination is required, but they have lower premiums and coverage.

What Are The Plans That Life Insurance Savings Group Offer

The first thing I noticed about the website was its lack of detail for life coverage.

The fine print could use some clarification and more information, but at least we were able to extract a few details from what little there is!

The actually reminds me of another company called haven life.

The way these burial insurance programs work is very simple. Life Insurance Savings Group offers simplified issue whole life insurance coverage. These cover funeral costs with premiums paid.

In fact, this is permanent life insurance where the coverage never goes up in price or decreases in value. Unlike a universal policy.

UL policies at this age don’t make sense for most and are a sure way to end up with less life insurance.

In addition, if approved you can get a full 100% first-day death level benefit for natural causes of death with minimal health issues to questions asked when applying. The best insurance companies will offer this, so it is not uncommon.

Other facts about this final expense life insurance policy include Program availability between ages 45 – 85; there’s no medical exam, and minimal health questions asked to apply.

These are all the things Insurance Savings Group does not cover! You pay a fixed monthly amount or a “savings contribution” to gain access to a pool of money that can be used right away for medical, dental, and vision care.

Your contributions are fully refundable if you never use the plan.

So most life insurance policies, you may qualify for as little as $2k with a maximum of $40k. Again, this is not uncommon with a competing life insurance company.

Term Life Insurance is a temporary plan that will expire after a specific period of time, but the death-graded benefit is guaranteed until then.

Once you reach the termination date, there’s no more coverage for your needs, and thus it becomes useless as well as expensive.

A life insurance saving group will offer to renew at a better price than purchasing whole life or universal life policies, which can last up until maturity depending on what type purchased (e.g., term).

Term plans often end around age 80 or even before one lives longer! With the term coverage lacking specifics, it’s entirely unknown when and if premiums rise over time.

However, the life insurance company or companies we represent will go to age 85 or 90.

This can be a big problem for anyone who is on a fixed income- what if your premium rises beyond your budget? Seriously, you cannot be without life insurance after paying into it.

Most important thing is to make sure your family receives a death benefit if death occurs.

With no answers from them in regards to their policy details or how much they will change each year without notice–it’s not surprising many clients drop this product after just one unexpected increase happens during its lifetime!

If you want to check into one of our top final expense life insurance companies for transparency, check out our articles on carriers RNA and AMAM. These are both A/A+ and offer great life insurance policies.

Read What Our Clients Say About Us

Are they Partnered With United Of Omaha

United of Omaha, which is an insurance provider with great policies for final expenses, issues the company’s policies.

This is an example of one such product, as it contains some benefits not found in other types of coverage plans offered through mutual companies like this one!

Here Are A Couple Of Sore Points That May Hurt

I don’t know about you, but I’m always on the lookout for a good deal. And when an offer seems too good to be true…well, it usually is!

It sounds like this company has got something special up its sleeve because they keep talking as though your acceptance of its service (whatever that may be) would never change.

In fact, guaranteed acceptance and all that jazz–but let’s take a closer look, shall we?

A huge red flag went off in my head right away because All guaranteed acceptance plans have a two-year waiting period.

Like Colonial Penn. If you die during this time, they will not pay out any death benefits to your beneficiaries!

If you’re looking for final expense insurance, it’s important to get a no-waiting period policy as soon as possible.

You see, we only offer these final expense policies to clients that have severe pre-existing conditions or are sick with active cancer or dementia.

In fact, the sooner your beneficiary gets their money from this type of coverage package and can use those funds without any waiting periods or commission fees attached, it will take them ages before they even see a penny!

A company that doesn’t satisfy the requirements to be trusted? Life Insurance Savings Group is not what you should expect from an insurance provider.

Do they offer basic information like their address or costs of policies?

Sadly, this shady organization does not allow any transparency in its business practices at all – with no site available outside http://www.lifeinsurancesavings .com/, which can quickly turn away customers who are seeking answers about rates and plans before purchase (not even through email!).

Mike Ditka Is A PAID Spokesman For Life Insurance Savings Group Commercial

You’ve probably seen the Life Insurance Savings Group’s well-known endorser, former Chicago Bears football coach Mike Ditka promoting their benefits.

He is known for his strong message and inspiring words that can be found in commercials or when talking about endurances with friends at parties!

Be sure to pay attention to the commercial next time you see it. It is laden with misrepresentations. In fact, use the pause button and read the fine print!! You’re Welcome in advance!!

Click below to find out the best life insurance Savings Group company that’s available in all 50 states. These are permanent coverage that is a simplified issue whole life insurance policy that will save money on your premiums.

What Companies Does Life Insurance Savings Group Offer

The website of the insurance company is full of logos from multiple other carriers. And if their ad isn’t enough to let you know they represent Mutual of Omaha, then perhaps these logos will do it for them!

Globe Life Insurance. AIG, Trustage, and Americo might be other companies with these practices, but we can’t know for sure because their website lacks transparency!

What Kind Of Rates Can You Expect At Life Insurance Savings.com

Life Insurance Savings is a well-known site that offers life insurance quotes. Unfortunately, they don’t show their prices upfront, and you need to contact one of their sales representatives for information about getting coverage at all!

It’s misleading because the price of final expense insurance is usually not found on a website.

That makes sense, right? (SARCASM)

Most people think they are going to see an actual quote from their provider when in reality it’s only extracted through commercial advertisements or other channels outside of what you would find with Google search results for “final expense policy prices.”

I’ve never met a bait that didn’t smell fishy. I mean, come on!

The truth is that their commercials are all false advertising and you’re just supposed to pick up the phone because they dangle this seemingly low price in front of us which gets our attention.

So proceed with caution when looking at what exactly that plan entails.

InsuranceForBurial.com Has So Much More To Offer

Life Insurance Savings Group is a company that we would never recommend for final expense insurance.

Life Insurance Savings Group are highly secretive about who they represent and what plans come with the purchase, as well as how much those policies’ funeral cost because their website doesn’t provide any information on this front whatsoever!

I don’t know about you, but I’m not going to do business with any company that operates like this. We’ve been around the block a few times.

In fact, we have more experience than any other company out there and can help you get through your final expense insurance needs in no time!

Here are three main reasons to come to us:

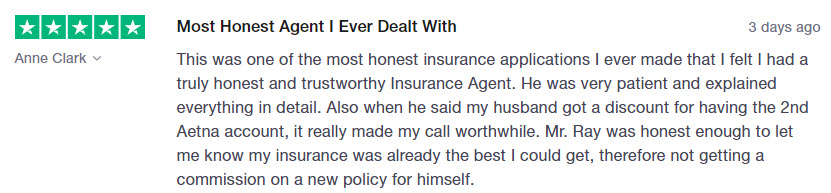

- Our customers are so happy with us that they Rate Us! We have a 4.9/5-star which is “Excellent” with online shoppers who were satisfied after dealing with our company. Below is just a sampling of what people had to say about theirs:

- We’re so transparent, we post our prices online. You can see what you’ll pay in advance, and there aren’t any hidden fees or surprises when the time comes for payment! You pay a fixed monthly payment!

- We have a team that will work hard to find the best life insurance company for you. We can typically get immediate coverage, and because we represent over 15 different companies in our network, there’s always one who’ll approve!

Related Articles

FAQs

Life Insurance Savings Group is a company that offers life insurance policies, particularly tailored to meet the needs of senior citizens. These policies often focus on providing financial security and peace of mind for seniors, with features that may include lower premiums, no medical exam requirements, and coverage for age-related health issues.

The key features likely include flexible coverage options, competitive pricing, and simplified underwriting processes. The benefits might include financial protection for families, coverage of final expenses, and possibly living benefits, which allow policyholders to access funds in case of chronic illness.

In comparison to other providers, Life Insurance Savings Group might offer more specialized policies for seniors, potentially with more competitive rates or more lenient health requirements. They may also focus on customer service and support tailored to the unique needs of older policyholders.

Conclusion

We think that Life Insurance Savings Group is a bad choice for final expense insurance. The Life Insurance Savings Group operates in secrecy, and we believe this means they’re hiding something from you.

They won’t tell you who their insurance providers are or what the plans they offer entail – which makes it hard to get any kind of information about them at all.

If you want an honest broker with plenty of transparency, then give us a call today!