Burial Insurance for Veterans: Everything You Need to Know

If you are looking for burial insurance for veterans, you have come to the right place.

As a veteran, you’ve served your country with honor and dedication. Now, it’s time to focus on protecting your legacy and ensuring that your loved ones are taken care of after you’re gone.

Burial insurance for veterans can provide the peace of mind and financial security you need to make that happen.

Easy Article Navigation

Eligibility Requirements for Burial Insurance for Veterans

To be eligible for burial insurance, you typically need to have served in the military and been honorably discharged.

Depending on the policy, you may also need to meet certain age requirements or health criteria.

In addition, some states have different regulations. For example, getting burial insurance in Iowa may differ in Philidelphia, Pa.

Who Qualifies

Veterans who meet the eligibility requirements for burial insurance may qualify for coverage.

This includes individuals who have served in the military and been honorably discharged, as well as their spouses and dependents in some cases.

Most burial insurance carriers will offer simplified issue whole life for ages 50-85.

Coverage Options for Burial Insurance for Veterans

When it comes to coverage options, burial insurance policies for veterans can vary widely in terms of the amount of coverage offered, the premiums charged, and the level of flexibility provided.

Some policies may offer a fixed amount of coverage, while others may allow you to choose the amount of coverage that best meets your needs.

There are products for disabled veterans over age 89, and up to age 95.

What Does Burial Insurance for Veterans Cover?

Burial insurance policies for veterans typically cover the cost of funeral and end of life expenses, such as the casket, burial plot, and other related costs.

Some policies may also offer additional benefits, such as coverage for final medical expenses or estate planning services.

How Much Do You Need?

The amount of burial insurance coverage you need will depend on a variety of factors, such as the cost of funeral and burial expenses in your area, your age, and your overall financial situation.

It’s important to choose a policy that provides enough coverage to meet your needs without breaking your budget.

Burial Insurance Costs for Male and Female Veterans

Burial insurance, also known as final expense insurance, is a type of life insurance that helps cover the cost of funeral and burial expenses.

This type of insurance can be particularly important for veterans, as they may not be eligible for burial benefits from the Department of Veterans Affairs if they were dishonorably discharged.

Below, we will explore the costs for male and female veterans.

Above all, rates for male veterans tend to be higher than those for female veterans. This is because men generally have a shorter life expectancy than women, which increases the likelihood of a payout.

Additionally, older veterans may have higher rates due to their increased mortality risk.

Female Veteran Burial Insurance Cost

| Age of Applicant | $5,000 | $10,000 | $15,000 |

|---|---|---|---|

| 50 | $12.86 | $23.06 | $33.08 |

| 55 | $14.97 | $26.94 | $38.90 |

| 60 | $18.04 | $32.87 | $47.70 |

| 65 | $22.11 | $41.01 | $59.91 |

| 70 | $28.07 | $53.12 | $78.18 |

| 75 | $37.81 | $72.41 | $107.01 |

| 80 | $50.82 | $98.43 | $146.05 |

| 85 | $69.55 | $135.90 | $202.25 |

| 90 | $149.69 | $296.41 | NA |

Male Veteran Burial Insurance Cost

| Age of Applicant | $5,000 | $10,000 | $15,000 |

|---|---|---|---|

| 50 | $15.37 | $27.73 | $40.08 |

| 55 | $18.72 | $34.43 | $50.13 |

| 60 | $22.72 | $42.42 | $62.13 |

| 65 | $28.41 | $53.82 | $79.22 |

| 70 | $36.47 | $69.93 | $103.38 |

| 75 | $50.22 | $97.43 | $144.64 |

| 80 | $71.44 | $139.73 | $207.99 |

| 85 | $97.97 | $192.74 | $287.51 |

| 90 | $176.59 | $350.21 | NA |

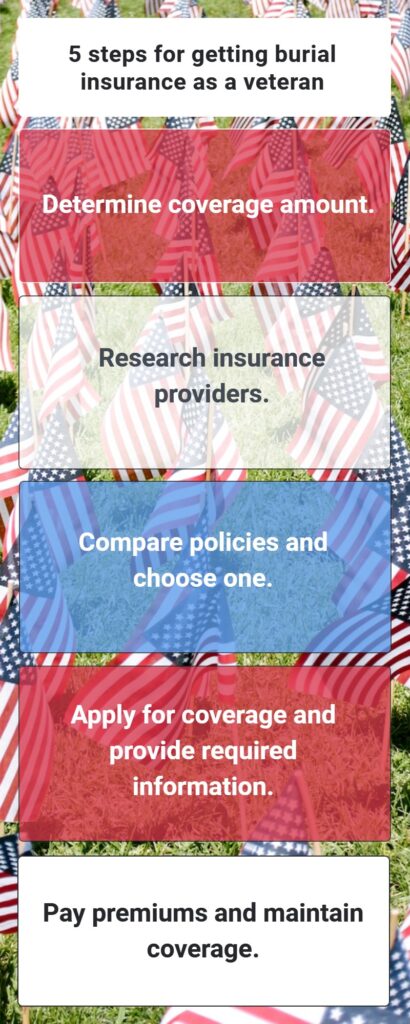

How to Choose the Best Burial Insurance Policy for Your Needs

When choosing a burial insurance policy, it’s important to compare your options carefully and consider factors such as the coverage amount, the premiums charged, and the level of customer service the insurer provides.

You may also want to consider working with an experienced burial insurance agent who can help you navigate the options and find the right policy for you.

Finding the best burial insurance company is just as important.

Comparing Burial Insurance Policies for Veterans: What to Look For

When comparing policies for veterans, be sure to look for policies that offer the coverage and flexibility you need at a price you can afford.

Think about insurer reputation, financial stability, and policy benefits.

Also, age is a factor in some states due to regulations. For example, finding burial insurance in NY for over 80 is challenging. However, we here have two carriers that will.

Tips for Choosing the Right Burial Insurance Provider

Pick a burial insurance provider with a good reputation and experience. Also, make sure you ask about the state you live in. For example, state insurance laws in Wisconsin may not be the same in Nebraska.

Read reviews, ask for references, and seek agent guidance.

Conclusion:

Protecting Your Legacy

Veterans can attain peace of mind and financial security through burial insurance. Know eligibility, coverage, and choose wisely for protection and security.

InsuranceForBurial.com helps veterans and families find the right burial insurance policy. We guide you to make optimal decisions for yourself and loved ones.

If you have any questions or would like to learn more about burial insurance for veterans, please don’t hesitate to contact us. We’re here to help you every step of the way.