How To Buy Burial Insurance After Heart Attack In 2025

Finding burial insurance after heart attack will come down to who you are working with. Overall, there are a few carriers that specialize in heart attacks, but so many that don’t!

The best time to buy burial insurance is before you have a heart attack. After a heart attack or other heart conditions, the risk of death can go up by 20%.

If you are in your 50s and haven’t bought burial insurance yet, it may be time for you to do so now.

Burial insurance can help give peace of mind that if something happens there will be money set aside for final expenses and arrangements.

There is no need to worry about what would happen if they died because with their purchase of this type of protection they know exactly what will happen next.

The Truth About Burial Insurance After a Heart Attack

One of our top questions, Does life insurance cover heart attack?

What you need to know, NOW!

Can you get life insurance after a heart attack?

If you are searching for, “burial insurance after heart attack”, it usually means that you kicked the can down the road and you put this off too long.

You might even think that you are unable to purchase a burial insurance policy. As a matter of fact, when you need it the most is when you can get it! As do most pre-existing conditions!

Can you get affordable life insurance after two heart attacks?

I have some GREAT NEWS. You can! So the final expense will be taken care of!

In fact, burial insurance is a simplified underwritten policy, (AKA Whole Life insurance after a heart attack).

Life Insurance After Heart Attack

Unlike term life insurance, a burial insurance plan is usually approved on the same day. Again, depending on what type of policy you qualify for will come down to how long it has been from your heart attack.

Here are the three types of coverage:

- Level Benefit

- Modified/Graded Benefit

- Guaranteed Issue

What medical conditions affect life insurance?

We will go over this in this article. Burial insurance or also known as funeral insurance or funeral quotes and different levels of burial insurance will determine your rate.

In some cases, after a heart attack, you may have arrhythmia or cardiomyopathy.

Can You Purchase Burial Insurance After a Heart Attack

As we mentioned earlier, YES YOU CAN! With SAME DAY APPROVAL!

In the event that you applied for life insurance and got denied, you still will be able to get a burial insurance policy.

Now depending on how long its been since the heart attack will determine if there will be a waiting period.

When you are qualifying for life insurance or burial insurance you will be asked some health questions. In addition, they may ask if you have a pacemaker.

This is to determine if there are any other health issues. There will be NO MEDICAL EXAM!

This will determine which type of coverage you qualify for.

Then you will have a choice of which burial or life insurance companies will take the risk then go over the life insurance quote.

How Long Will I Have To Wait For Burial Insurance After a Heart Attack

Can you get life insurance with a pre-existing condition?

This is when dealing with the right agent will make all the difference.

When getting approved for life insurance or burial insurance and getting the best life insurance rates, it is crucial that you deal with an agent that specializes in burial insurance.

Can you get life insurance if you have a stent?

Above all, the knowledge of each carrier’s specialties is pivotal. Most carriers will want you to wait over 2 years to get a level-benefit burial policy. However, what if you just had one stent?

What if you just had a heart attack and you are being treated? Do you have a defibrillator?

Then the only policy would be a guaranteed issue where there will be no questions asked. These types of policies come with a 2-year graded period.

This means that if you die of an “Illness” in the first two years then all premiums will be refunded plus 10%.

However, this policy will cover accidental death from day one. In fact, our go-to carrier for this product also offers living benefits as well. Again, after the 2 years is up then the death benefit will be paid 100%!

Burial Insurance Underwriting After Heart Attack– What You Need To Know Now!

So how far back do life insurance companies look at medical records? This is a burning question by many!

Does insurance cover heart attack?

When it comes to underwriting for burial insurance after a heart attack it’s nice to know there will be no medical exams!

In addition, no stress tests or medical records will be requested unlike some term life insurance carriers will demand.

Nope, it’s a simple prescription check and answers to health questions like have you been diagnosed with CHF.

Now depending on which carrier you will go to will determine the qualifying questions that will be asked.

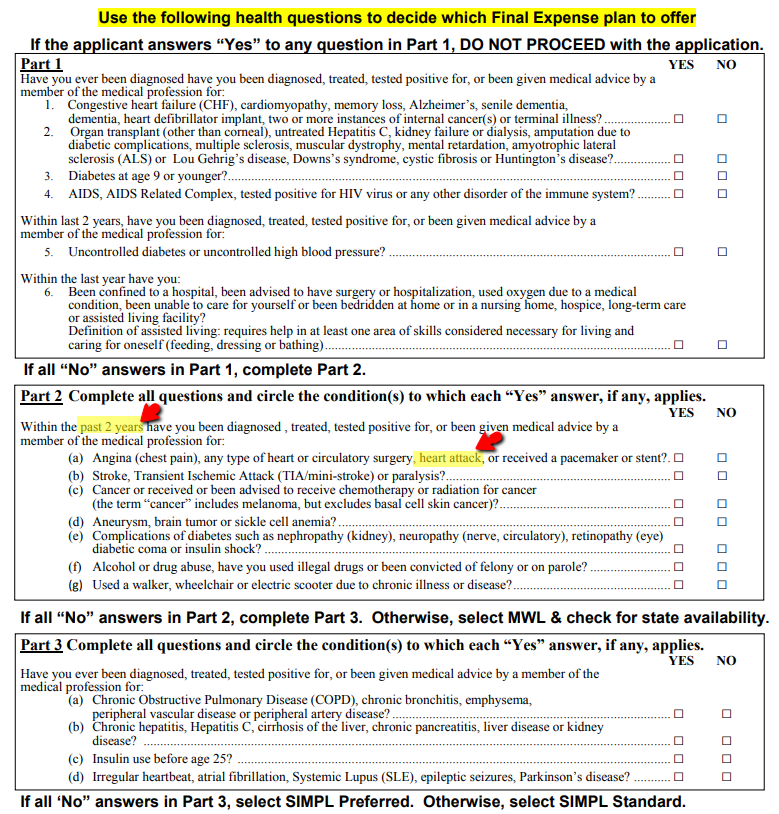

Here is a great example of one of our go-to carriers and the qualifying questions they will ask:

Read What Our Clients Say About Us

Best Life Insurance After A Heart Attack

Liberty Bankers Life’s final expense has 3 parts of their application to see which product you may qualify for before rates are shown. We are picking Liberty Bankers Life because they are amongst the top rates for burial insurance and have very liberal underwriting with three qualifying products.

In most cases, a client will be approved at the standard rate! This means active policy from day one!

Here is an example of a 70-year-old male looking for a $10,000 burial policy after a heart attack.

Best Burial Companies After Heart Attack

When picking a burial company for coverage it is just as important the agent you pick as it is the carrier you choose.

Most agents that you talk to either will tell you-you can’t get coverage because of lack of knowledge or offer a guaranteed acceptance policy because they don’t know any better.

Overall, it is the client’s money they are rolling the dice with which is unacceptable as far as I am concerned.

With that said, when it comes to a client purchasing burial insurance after a heart attack it should be more looking at the success of achieving the goal than being too picky.

So when it comes to heart attack we offer the three top options and make it simple!!

The rates and top carriers below are for 10k in burial insurance for a 70-year-old male Diagnosed heart attack within last 12 months.

| Company Name | Monthly | Coverage Type |

|---|---|---|

|

$98.57 | Standard |

|

$99.18 | Years 1-2 – ROP +10% Year 3+ – 100% of the face amount |

|

$104.50 | Year 1 – ROP +5% Year 2 – 50% of the face amount Year 3 – 100% of the face amount |

|

$105.73 | Year 1 – 30% of the face amount Year 2 – 70% of the face amount Year 3+ – 100% of the face amount |

|

$116.32 | SIMPL Modified Years 1-3 – ROP +10% interest Year 4 – 100% of the face amount Year 5 – 105% of the face amount Year 6+ – 110% of the face amount |

Getting Life Insurance After A Heart Attack

Who Should Buy Whole Life Insurance

If you are looking for affordable burial insurance after a heart attack and it has been over two years then I would stick with Liberty Bankers Life.

However, you might want to consider AIG guaranteed issue policy as it is better priced with the above example. But you need to be sure.

Remember, find an experienced burial insurance agent. We here at InsuranceForBurial.com are experts in finding you the right coverage that meets your goals.

For more information on Heart Attacks and Disease, CLICK HERE.

My name is Daniel Ray, feel free to reach us, 855-380-3300.

Related Articles

FAQs

Are there any restrictions on who can be my beneficiary?

Usually, you’re free to choose anyone you trust, like a family member or a close friend, as your beneficiary. This person will get the insurance money when you pass away.

Is there a difference between burial insurance and life insurance?

Yes, there’s a big difference. Burial insurance is specifically for paying funeral expenses and typically offers a smaller payout. Life insurance, on the other hand, has a broader scope and provides more coverage for various needs.

What happens if I can’t keep paying for the insurance?

If you’re having trouble paying for your insurance, the best thing to do is talk to your insurance company right away. They might have options like a grace period to help you keep your coverage.

What kind of health questions will I be asked when applying?

When you apply, the insurance company will ask about your health. This includes questions about your heart attack, like when it happened and any treatment you’re receiving. They do this to understand your health situation better.

Can my family use the insurance money for other expenses?

Yes, they can. Once your family receives the insurance money, they can use it for any expenses they have, not just funeral costs. This can be a big help during a difficult time.

How long does it take to get approved for burial insurance?

The time it takes to get approved can vary. Some plans offer quick approval, sometimes even on the same day you apply. Others might take a little longer, especially if they need more detailed health information.

Conclusion

It’s never too late to buy burial insurance. If you are in the market for a new life insurance policy, talk with your agent about adding death benefits to protect your loved ones from financial hardship if something were to happen to you.

You may be surprised by how affordable this coverage can be and even get it without taking any medical tests at all. Contact us today for more information!

More Burial Insurance Resources