Why Mutual of Omaha Burial Insurance Is The Best In 2024

Mutual of Omaha Burial Insurance has always been a trusted name in the insurance game.

This company is one of the oldest life insurance and financial services providers in America, with roots dating back to 1909.

Their longevity and success are due to their dedication to putting customers first; they offer great customer service, low prices on quality products and services, and more than 115 years of experience.

Mutual of Omaha will be around for many more generations to come!

Although you may have read many final expense Insurance Reviews, we hope you get some insight into Mutual of Omaha burial insurance review coverage from our point of view.

You will find that Mutual of Omaha living promise is one of the best burial insurance and/or final expense insurance options on the market with approval coming with a few health questions, no medical exam, and no years waiting period if you qualify.

Read on to see what Mutual of Omaha offers.

Is Mutual of Omaha a Good Insurance Company

Before we start discussing United of Omaha life insurance reviews let’s bring you back in time!

Above all, if you are a senior and the name United of Omaha life or Mutual of Omaha life insurance policy or final expense insurance does not ring a bell, then this should be familiar.

The table below has the features of Mutual of Omaha’s final expense product, Living Promise.

- No medical exams required.

- Ages 45-85

- Level Plan: $2,000-$50,000

- Graded Plan: $2,000-$20,000

- Simple and Efficient, in minutes

- eApp, DocuSign

- Approved instantly, to a few days

4.8

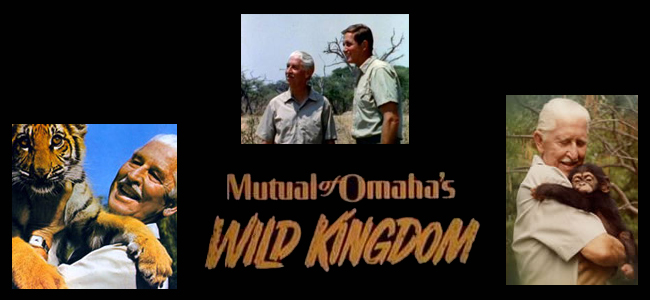

Mutual of Omaha Wild Kingdom Theme Song

If you watched TV in the 1960s, 1970s, & 1980s then you probably remember the American Documentary television program that featured wildlife and nature.

If you are wondering who was the host of Wild Kingdom it was Marlin Perkins. Marlin Perkins narrated the show until he retired in 1985.

He later died on June 14, 1986, at the age of 81.

So I hope this brought you, seniors, back to memory lane because I am sure this TV show was something that you watched with family, kids, and maybe grandkids.

Ok, now that you remember who they are, let’s get down to the real reason why you are here…

Just How Good Is a Mutual of Omaha Insurance Policy?

In 2023, most people are not even close to being able to retire. In fact, nearly 50% of Americans have less than $10k saved for retirement.

The only way you can make sure that your family will have money in the future is by getting final expense life insurance now.

This final expense Insurance policy they offer has been a leader in providing affordable coverage and protection for over 100 years.

They offer a variety of different types and levels of coverage so that you can find what’s right for you and your situation.

These are the best because they’re backed by a large company with many years of experience! Overall, making Mutual of Omaha one of our best burial insurance carriers.

What Types of Life Insurance Does Mutual of Omaha Sell?

Well, this is a great question. However, a better question would be “What doesn’t Mutual of Omaha sell?” rather than “What kind does Mutual of Omaha not sell?”

Besides final expense insurance or burial insurance for Seniors, Mutual of Omaha pretty much has every product you are looking for when you are looking for life insurance.

In fact, some of these can be issued same-day coverage with no waiting period. Here are some of the products that they specialize in:

- Children’s Whole Life (No Medical Exam)

- Critical Advantage (chronic kidney disease, congestive heart failure, systemic lupus, Heart Attack, Stroke, Cancer Policies up to age 89)

- Guaranteed Advantage (Accidental Death, up to age 70)

- Guaranteed Universal Life Express/Indexed Universal Life (No Medical Exam up to age 70)

- Living Promise (Final Expense Product) No Medical Exam, No Waiting Period

- Long Term Care (Up to age 79)

- Medicare Supplements (Ages 65-99)

- Priority Income Protection (Ages 18-61)

- Term Life Answers (Ages 18-80)

- Term Life Express (Ages 18-70) No Medical Exam

In this article, we will primarily focus on YOU, the senior, and the life insurance products that matter most to you.

How Is Mutual of Omaha Life Insurance for Seniors

Now that we went over what kind of insurance Mutual of Omaha sells, let us talk about which products mean the most to the senior’s funeral insurance for ages 65 to 85. The key here is funeral insurance plans for those over 65.

For example, Mutual of Omaha insurance for seniors will consist of their final expense product, critical care, medicare supplements, and long-term care products.

We will focus more on Mutual of Omaha life insurance products as you came to this article for that reason.

In addition, if you are looking for burial insurance or final expense for parents you will want to pay close attention to this article.

Get the low down on burial insurance quotes for seniors with Mutual of Omaha Final Expense Insurance with no waiting period!

Mutual of Omaha Living Promise

Above all, Living Promise is one of the best final expense policies you can have. You have a big name company with a solid history in combination of among the lowest prices.

However, there are two Living Promise available, level and graded. Which policy you get will be determined of the questions that are answered on the applicaiton. If you answer yes to any of the following questions then you will qualify for the graded.

- Diabetes before age 45?

- Diabetes at any age with complications or history of Retinopathy (eye), Nephropathy (kidney), Neuropathy (nerve), Peripheral Vascular Disease (PVD or PAD), Coronary Artery Disease (CAD) or Stroke?

- Hepatitis C?

- Chronic Lung Disease, including Chronic Obstructive Pulmonary Disease (COPD), Chronic Bronchitis, Emphysema, or Sarcoidosis?

Below are the features of both the level and the graded living promise policy from Mutual of Omaha.

Characteristics of Living Promise Whole Life Level and Graded:

- Whole Life Insurance

- Lifetime Duration, (as long as you pay your premiums)

- Premiums are Level, they never go up

- Cash value does accumulate (after 2 years)

- No Medical Exams Required, just a few health questions

- 2 year waiting period is ONLY for Graded

- Approval time can be as fast as immeidate, to a few days

👇Click on the buttons below to see the policy features👇

PLUS:

- We offer competitive premiums that fit many budgets

- Simplified underwriting. No medical exams – coverage is based on your answers to a few simple health questions.

- A great product with a strong brand and from a stable and secure company that you know

As an independent national agent with clients in every state, Mutual of Omaha is my #1 carrier. As long as we are very detailed on the application process, they will be lenient with underwriting.

In addition, United of Omaha graded benefit whole life insurance is among the best-priced graded policies, especially for tobacco users.

Pros and Cons of Living Promise

Guaranteed Whole Life Insurance

United of Omaha does offer a highly competitive Guaranteed Issue Whole Life through their website, but it is a two-year waiting period and usually 30-50% higher price than the best rates.

It is always best to check with an independent insurance agent that is knowledgeable about all the guidelines to isolate the best product and carrier. That’s our specialty at InsuranceForBurial.com.

Unless you have active cancer, dementia, or recent heart surgery, a guaranteed whole life insurance policy should be your LAST RESORT!!

Mutual of Omaha Burial Insurance Rates

What about Mutual of Omaha final expense insurance rates?

Above all, United of Omaha life insurance company has the most affordable rates especially when it comes to their final expense life insurance product.

Again, with this product, you can get coverage from ages 45-85 in most states. Here is a sample of rates for the level of benefit for a male ages 45-85 and a death benefit payout is $15,000.

We picked this because it will cover any burial and cremation. (See below for the Mutual of Omaha final expense quotes with our United of Omaha Quoting Tool)

Mutual of Omaha whole life insurance calculator for Living Promise

| Age (Male) | Face Amount | Monthly Premium | Annual Premium |

|---|---|---|---|

| 45 | $15,000 | $39.06 | $438.90 |

| 46 | $15,000 | $39.92 | $448.50 |

| 47 | $15,000 | $40.90 | $459.60 |

| 48 | $15,000 | $42.00 | $471.90 |

| 49 | $15,000 | $43.24 | $485.85 |

| 50 | $15,000 | $44.42 | $499.05 |

| 51 | $15,000 | $45.56 | $511.95 |

| 52 | $15,000 | $46.51 | $522.60 |

| 53 | $15,000 | $47.50 | $533.70 |

| 54 | $15,000 | $49.76 | $559.05 |

| 55 | $15,000 | $52.32 | $587.85 |

| 56 | $15,000 | $54.49 | $612.30 |

| 57 | $15,000 | $56.58 | $635.70 |

| 58 | $15,000 | $58.73 | $659.85 |

| 59 | $15,000 | $61.16 | $687.15 |

| 60 | $15,000 | $64.04 | $719.55 |

| 61 | $15,000 | $68.02 | $764.25 |

| 62 | $15,000 | $72.00 | $808.95 |

| 63 | $15,000 | $75.23 | $845.25 |

| 64 | $15,000 | $78.77 | $885.00 |

| 65 | $15,000 | $83.12 | $933.90 |

| 66 | $15,000 | $88.18 | $990.75 |

| 67 | $15,000 | $93.17 | $1,049.85 |

| 68 | $15,000 | $98.66 | $1,108.50 |

| 69 | $15,000 | $104.58 | $1,175.10 |

| 70 | $15,000 | $110.31 | $1,239.45 |

| 71 | $15,000 | $116.61 | $1,310.25 |

| 72 | $15,000 | $124.38 | $1,397.55 |

| 73 | $15,000 | $132.59 | $1,489.80 |

| 74 | $15,000 | $140.70 | $1,580.85 |

| 75 | $15,000 | $148.36 | $1,666.95 |

| 76 | $15,000 | $158.96 | $1,786.05 |

| 77 | $15,000 | $169.60 | $1,905.60 |

| 78 | $15,000 | $181.60 | $2,040.45 |

| 79 | $15,000 | $192.68 | $2,164.95 |

| 80 | $15,000 | $207.99 | $2,337.00 |

| 81 | $15,000 | $223.32 | $2,509.20 |

| 82 | $15,000 | $238.64 | $2,681.40 |

| 83 | $15,000 | $254.93 | $2,864.40 |

| 84 | $15,000 | $271.22 | $3,047.40 |

| 85 | $15,000 | $287.51 | $3,230.40 |

👇Take a break, see what our clients are saying about us👇

What Conditions Does Living Promise Cover as A Niche

Mutual Of Omaha Burial insurance for those with pre-existing medical conditions is finally available! Conditions like:

- Ankylosing Spondylitis, United of Omaha Burial Insurance (Living Promise), Level death benefit(no waiting period).

- Diabetes diagnosed 50 and over, Mutual of Omaha Burial Insurance (Living Promise), Level (no waiting period).

- Seniors with Atrial Fibrillation and on blood thinners, United of Omaha Burial Insurance (Living Promise), Level (no waiting period).

- If you have been diagnosed with cancer and treatment stopped 4+ years ago, Mutual of Omaha Burial Insurance (Living Promise), Level (no waiting period).

- Stroke over two years ago, Mutual of Omaha Burial Insurance (Living Promise), Level (no waiting period).

In addition to Mutual of Omaha, another great carrier for these health impairments are Royal Neighbors of America.

Best Burial Insurance Companies For Diabetics · Royal Neighbors of America · Mutual of Omaha.

If you need a Guaranteed Issue due to diabetic complications then AIG Guaranteed Issue ~ No health questions asked will be the best option.

They come with living benefits and you can access up to 50% of the death benefit without passing away.

The living benefits cover terminal illness and critical/chronic illness and accumulate cash value.

Overall, Mutual of Omaha final expense insurance is still the Cadillac of burial insurance policies paying double the death benefit faster than anyone.

In fact, you need quality to have the security of the death benefit be paid out in a fast and reasonable time.

Above all, making them the best insurance company for final expense life insurance and permanent life insurance coverage.

They are still our pick for whole-life insurance policies.

Mutual of Omaha Term Life Insurance Options

The term life insurance policies offered by United of Omaha are a great way to be protected in case something happens. They have features and characteristics that will work for your needs, so they’re worth checking out!

Available term periods are 10, 15, 20 years, or 30 years. Level-type premiums are guaranteed with coverage amounts starting at $100K for applicants aged 18 – 80!

Online estimates can be obtained but a policy has to be purchased through an agent in person.

In addition, Mutual of Omaha burial insurance fully underwrites its policies until they convert into any permanent option that best suits your financial needs!

Overall, burial insurance coverage is a great option for those who want to protect themselves and their loved ones, without having the hassle or cost associated with purchasing full coverage.

Term policies are a type of insurance that will pay for final expenses. The money will be paid all at once, but beneficiaries can choose to get the money in payments over time if they want. You can also get an estimate online!

Life insurance coverage is a complicated and often forgotten topic for many people.

Mutual of Omaha burial insurance offers an easy-to-understand term life insurance plan that provides tax-free death benefits as well as other riders such as waiver premiums, accidental death benefits, or children’s riders to help you cover those important moments in your family’s lives with peace of mind!

The company also offers a terminal illness rider, which is also called an accelerated death benefit rider.

Guaranteed Advantage By Mutual of Omaha

What is Mutual of Omaha’s guaranteed advantage?

Is accidental death insurance worth it? Yes! Depending on your occupation like being a truck driver, or working on an oil rig.

Above all, you can purchase this up to age 70 with a maximum face amount of $500k. Finally, life protection advantage that covers hazardous occupations.

In addition, Mutual of Omaha guaranteed advantage ROP is an accidental policy that offers a return of premium. So there is nothing wrong if you get all your premiums back if you hold the policy long enough.

However, although getting your money back sounds good, you lose 3.5% a year with inflation.

Also remember, seniors’ funerals cover for the life of the policy! Of course, unless you win the lotto and do not need the coverage any longer!

Mutual of Omaha Critical Illness Insurance

Critical illness insurance protects you from having to pay a lot of money if you get sick with a serious illness.

With policies like these, there are many covered conditions and they can help provide peace of mind when things go wrong at work or home.

This type of insurance pays money to the person with the insurance if they get sick with cancer, dementia, heart attack, or stroke.

So they don’t have to worry about their medical bills or other expenses related to that ailment.

It also offers disability benefits in addition as well as a death benefit which could come into play when an individual passes away due not only from a critical condition but also because it’s hard on those left behind financially without someone providing income towards household responsibilities such as food, shelter, childcare etcetera!

A Critical Illness insurance policy is a good way to pay for your high deductible health care coverage.

If you happen to be an owner of a small business, it’s important that your operations don’t go under when an illness or treatment keeps you from working temporarily.

The peace of mind offered by this type of protection is worth looking into!

United of Omaha Life Insurance Company Phone Number

Mutual of Omaha Burial Insurance phone number: 1 (800) 228-7104

Customer Access: United of Omaha’s final expense information.

Access is easy if you want to manage your account: http://www.mutualofomaha.com/

Mutual of Omaha address: 3300 Mutual of Omaha Plaza, Omaha, Nebraska 68175United States

https://mutual-of-omaha.pissedconsumer.com/customer-service.html

Mutual of Omaha Burial Insurance Payment

How do I pay my bill online?

For bill pay updated information review, please CLICK HERE. This is an easy way to manage your account.

If you are looking to: pay bills and update information call: (800) 775-6000.

Life Insurance Claims

Mutual of Omaha burial insurance is a company that will help take care of your family financially if something happens to you.

They ensure you have enough to live on in the event something happens, such as death or disability.

Mutual of Omaha Accidental Death Insurance provides financial support for your loved ones if you die in an accident.

How do I file a claim? Call (800) 775-1000.

To request a death benefits claim form, call (877) 894-2478.

The Mutual of Omaha claims address:

3300 Mutual of Omaha Plaza, Omaha, Nebraska 68175 United States

Mutual of Omaha Agent Login

For independent agents, sign in to the agent portal, and CLICK HERE.

The phone number for producers: (800) 475-4465.

Agent support phone number: (800) 775-7896.

Mutual of Omaha customer service: (800) 228-7104

Related Articles

FAQs

Mutual of Omaha Burial Insurance is a life insurance policy specifically designed to cover funeral expenses and other related costs.

Eligibility varies, but typically individuals aged 45 to 85 are eligible for coverage, without the need for a medical exam.

Benefits include guaranteed coverage, fixed premiums, and a tax-free death benefit, designed to provide financial support for end-of-life expenses.

Unlike traditional life insurance, burial insurance focuses specifically on covering funeral costs and is generally lower in value but easier to qualify for.

No, the policy value and premiums are fixed and will not increase over time.

No, a medical exam is typically not required, making it accessible for those with health issues.

You can purchase it by contacting a licensed insurance agent or directly through Mutual of Omaha’s website.

There is usually no waiting period; coverage often starts immediately upon policy issuance.

Yes, there are options for additional riders, such as accelerated death benefits for terminal illness.

Beneficiaries can file a claim directly with Mutual of Omaha, typically requiring a death certificate and completed claim form.

Conclusion

United of Omaha is one of the top companies in the life insurance industry for final expenses.

They are a company that has been around for over 100 years and is trusted by millions of Americans. They sell products like universal life insurance, whole life insurance, final expense whole life, term life insurance, and medicare supplement insurance.

If you want to know more about these policies or need help choosing the right one for your situation, fill out our quick quote form. An expert will help you today!

For an Omaha Mutual life insurance final expense quote today, fill out the form to the right.